PrimeXBT Fees Explained: Essential Information for Traders

When it comes to trading on platforms like PrimeXBT, understanding the fee structure is crucial for maximizing profits and managing your investments effectively. The fees incurred can significantly affect trading outcomes, and it is essential to know what to expect before diving into trades. This guide aims to provide a comprehensive overview of the various fees associated with trading on PrimeXBT, including PrimeXBT Fees https://primexbtnew.com/fees/, withdrawal fees, deposit fees, and other potential costs.

1. Overview of PrimeXBT Fee Structure

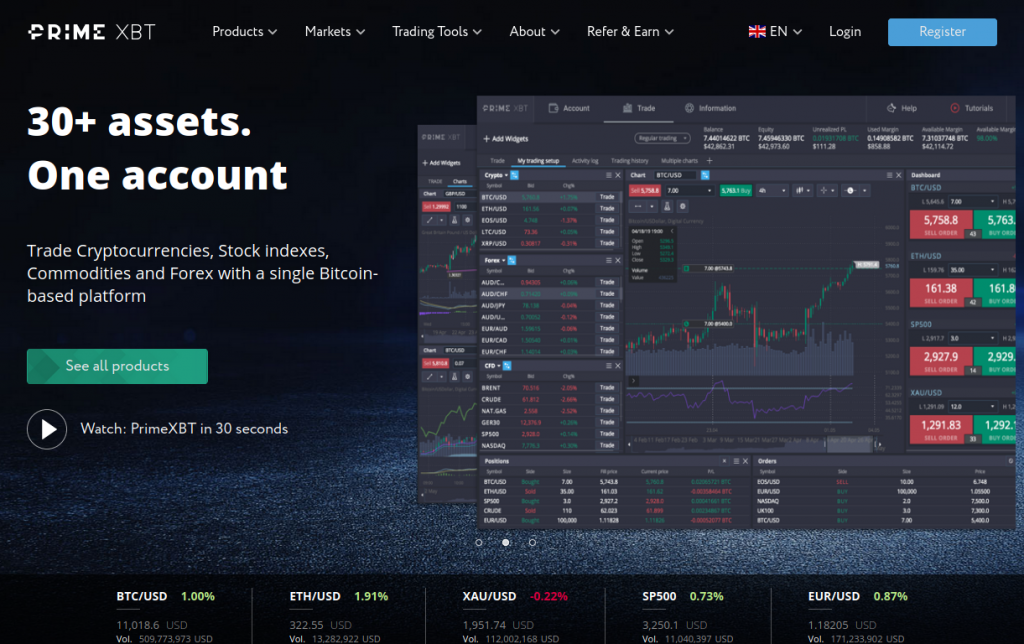

PrimeXBT is a cryptocurrency margin trading platform that has gained popularity for its competitive trading services. One of the key factors that attract traders to PrimeXBT is its relatively low fee structure compared to many other trading platforms. The fees can be broken down into three main categories:

- Trading fees

- Withdrawal fees

- Deposit fees

In addition, there are other potential costs that users should be aware of, such as fees for leveraging positions and other trading-related activities.

2. Trading Fees on PrimeXBT

Trading fees are the primary costs that traders incur when executing trades on any platform. On PrimeXBT, trading fees are calculated as a percentage of the transaction value, and they vary based on the type of asset being traded. The platform adopts a maker-taker model where fees are determined by whether you are adding liquidity to the market (maker) or taking liquidity away (taker).

The typical trading fees are:

- Maker Fee: The maker fee is usually lower and is applied when a trader places an order that adds liquidity to the order book.

- Taker Fee: The taker fee applies when a trader places an order that matches an existing order in the order book, effectively removing liquidity.

Understanding the difference between maker and taker fees is essential for traders who often execute large orders, as it can lead to significant cost savings.

3. Withdrawal Fees

Whenever a trader withdraws their funds from the PrimeXBT platform, they may encounter withdrawal fees. These fees can vary depending on the cryptocurrency being withdrawn. Different cryptocurrencies have different network fees, which can fluctuate based on network congestion. Generally, withdrawal fees are comparatively low, but users should check the latest fees directly on the PrimeXBT website.

It’s important to note that withdrawal fees are not charged by PrimeXBT but are rather the fees incurred by the blockchain network itself. Therefore, they may change frequently, so it is recommended to monitor these fees regularly, especially before making large withdrawals.

4. Deposit Fees

In contrast to many other platforms, PrimeXBT does not charge deposit fees for transferring funds into the platform. Users can deposit cryptocurrencies without incurring additional costs, allowing for more straightforward capital management. However, traders should ensure they are aware of any potential fees associated with their own cryptocurrency wallets or exchanges from which they are depositing. It’s essential to check with your service provider to avoid unexpected charges.

5. Other Considerations

Aside from the primary fees discussed, traders should be aware of a few additional factors:

- Leverage Fees: Trading with leverage on PrimeXBT allows users to control larger positions with a smaller amount of capital. However, using leverage also incurs additional costs, primarily in the form of overnight funding fees. These fees can accumulate quickly, so it’s essential to understand how they affect long-term positions.

- Inactivity Fees: While PrimeXBT strives to offer a user-friendly experience, traders should also be mindful of the inactivity fees that may apply to accounts that have been dormant for an extended period. Keeping your account active, even with minimal trading, helps avoid additional costs.

6. How to Minimize Fees on PrimeXBT

Traders can implement several strategies to minimize fees on PrimeXBT:

- Utilize Maker Orders: By placing limit orders instead of market orders, traders can reduce their trading fees by becoming a maker rather than a taker.

- Monitor Market Conditions: Being aware of market conditions can help you avoid higher taker fees during periods of high liquidity.

- Plan Withdrawals Wisely: Timing your withdrawals based on network fees can save you money. For example, researching peak times for network congestion can result in lower withdrawal fees.

- Educate Yourself: Stay informed on the fee structure and any changes to the fee landscape. PrimeXBT frequently updates its policies, and being proactive can help mitigate costs.

Conclusion

Understanding the fees associated with any trading platform is crucial for maintaining profitability and managing your overall trading strategy effectively. PrimeXBT provides a competitive fee structure that can be advantageous for traders if navigated wisely. By familiarizing yourself with trading, withdrawal, and potential hidden costs, you can enhance your trading effectiveness and optimize your investment outcomes. As you consider your trading options, keep in mind these factors and strategies to utilize PrimeXBT to its fullest potential.