Forex trading often evokes heated debates about whether it is a legitimate investment strategy or simply a form of gambling. While both activities involve risk and speculative outcomes, is forex trading gambling Trading Platform PH helps to illuminate the distinct nature of forex trading and its underlying principles. In this article, we will explore the fundamental differences between forex trading and gambling, the psychological aspects influencing traders, the strategies employed in the forex market, and much more.

Understanding Forex Trading

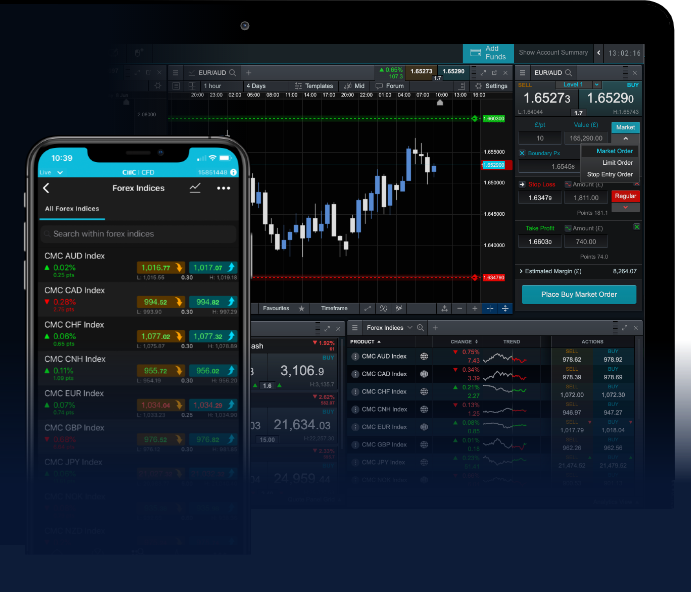

Forex, short for foreign exchange, is the global marketplace for trading national currencies against one another. With a daily trading volume exceeding $6 trillion, forex is the largest financial market in the world. Unlike gambling, which typically involves games of chance, forex trading is influenced by economic indicators, geopolitical events, and market sentiment. Traders analyze charts, trends, and other data to make informed decisions regarding currency pairs.

The Role of Analysis in Forex Trading

Forex traders utilize two main forms of analysis: fundamental analysis and technical analysis.

- Fundamental Analysis: This approach considers economic indicators such as Gross Domestic Product (GDP), employment rates, interest rates, and geopolitical events to predict currency movements. For example, if a country’s employment rates rise, it might strengthen its currency against competitors.

- Technical Analysis: This method focuses on historical price movements, chart patterns, and various technical indicators to forecast future price changes. Traders look for trends, support and resistance levels, and momentum to decide when to enter or exit the market.

The Psychology of Forex Trading

The psychological aspect of forex trading is crucial to success. Emotions such as fear and greed can significantly influence trading decisions. Unlike gambling, where outcomes may feel random, forex traders can employ strategies based on analysis and risk management to influence their chances of success. Successful traders develop a disciplined mindset and stick to their trading plans, which helps mitigate emotional decision-making.

Risk Management in Forex Trading

Effective risk management is a hallmark of successful forex trading. Traders typically use stop-loss orders to limit potential losses and take-profit orders to secure gains. Risk management strategies allow traders to control their exposure and minimize the risk of catastrophic losses, which is a key differentiator from gambling, where bets are often made without a clear strategy for risk management.

Comparing Forex Trading and Gambling

Similarities

Despite the fundamental differences between forex trading and gambling, there are some similarities worth noting:

- Both involve risk and uncertainty regarding outcomes.

- Both can lead to financial losses if not approached with caution.

- Traders and gamblers may experience high levels of stress and emotional turmoil.

Differences

However, significant differences set forex trading apart from gambling:

- Informed Decision-Making: Forex trading relies on data, analysis, and strategy, while gambling is often based on chance.

- Market Influence: Forex traders can impact the market through their trades, whereas gamblers are typically passive participants in a game of chance.

- Long-Term Success: With proper education and risk management, traders can achieve long-term profitability, while gambling often favors the house in the long run.

Strategies for Successful Forex Trading

To succeed in forex trading, one must adopt various strategies that can help mitigate risks and enhance returns. Here are some popular strategies:

- Day Trading: Involves making multiple trades within a single day, capitalizing on small price movements. Day traders must be vigilant and capable of making quick decisions.

- Swing Trading: Focuses on holding positions for several days to capitalize on expected price swings. This style requires less frequent trading but still demands analysis and risk management.

- Scalping: A trading strategy that involves making dozens or hundreds of trades in a day, aiming to «scalp» small profits from each trade. Scalpers need to be highly disciplined and efficient.

Conclusion: Forex Trading is Not Gambling

While forex trading entails risks and uncertainties, it fundamentally differs from gambling. Successful forex trading is rooted in analysis, strategy, and risk management rather than reliance on chance. Understanding the nuances between the two will empower traders to make informed decisions and navigate the forex market more effectively. With proper education, practice, and discipline, individuals can transform their forex trading activities into a purposeful investment venture rather than a gamble.

Final Thoughts

As the lines between traditional investment and gambling continue to blur in the digital age, it is vital for traders to understand where their activities fall on that spectrum. Engaging in forex trading with a mindful approach, grounded in education and strategic planning, can yield positive results and foster a deeper understanding of global financial dynamics.